Home & Holiday Let

Mortgages, Done.

"Just 5 mins to your free, personal,

holiday let mortgage assessment"

Start an application now to support your property purchase

Remortgage or a brand new mortgage, get started now

See what you could borrow without creating an account

Your Expert Home & Holiday Let Mortgage Broker

Your Success

From the outset, one of our highly skilled and experienced advisors will look after you, and lead the way as we cross the mortgage minefield, giving you the very best chance of success with your property transaction.

Deep Expertise

Unlike other brokers, we have a deep specialism in holiday let mortgages, built from years of experience. Residential, second home or buy-to-let mortgages? No problem, our team can handle them all, whether in personal name or via a Limited Company.

How it works

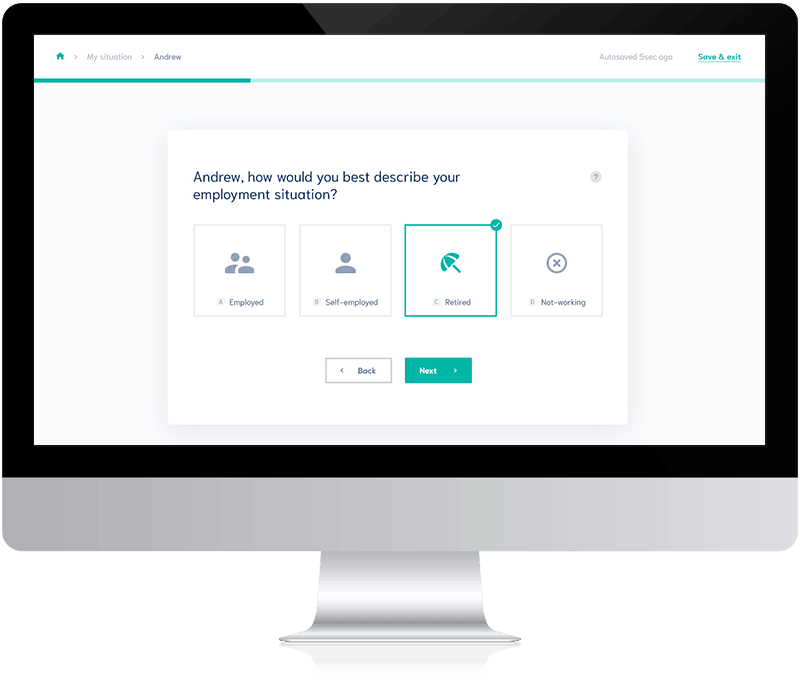

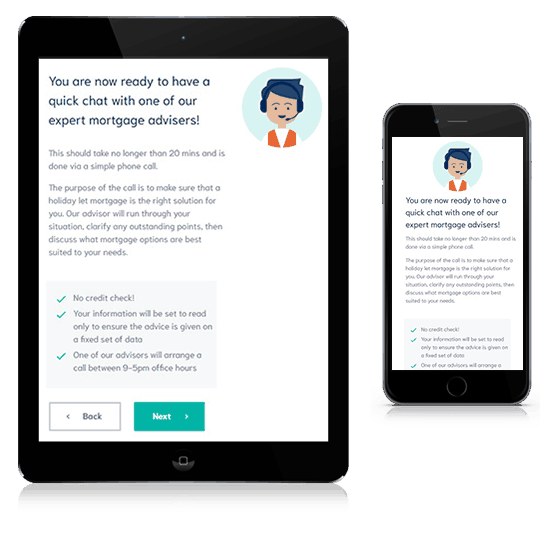

Complete online system

Best suitable rate found

Application submitted

Mortgage offer

Read our expert advice

We are holiday let mortgage experts and we regularly write detailed articles on various topics to help our customers navigate this space with confidence. Click on one of our current articles below, or visit our Help and Advice centre and enjoy all of our original content, written for you.

Here at Holiday Cottage Mortgages, we think getting a mortgage for your holiday let should be easy and transparent. That’s why we put together a platform that could help the process move much more smoothly for customers, minimise paperwork and give people the best chance of success from their application.

We are holiday letting experts with experience working in the industry, and so we know the challenges of the mortgage process for new holiday lets across the UK. We can help you manoeuvre across the bumps that appear along the way whether you’re a cottage in the highlands of Scotland, house on the coast of Wales or a holiday home tucked in a beautiful village in England.

That leaves you to focus on what you want to do: running a successful holiday let business and filling it with happy holidaymakers!

Start an application now to support your property purchase

Remortgage or a brand new mortgage, get started now

See what you could borrow without creating an account