Welcome to Holiday Cottage Mortgages (HCM), a unique platform specialising in the arrangement of holiday let finance.

This guide is designed to help new users to the system understand their way around, showing how the website works and how to get the most out of it, based on your own personal circumstances.

How to use our site

To help you get the most of out of our platform, we have highlighted several common situations below, and what actions are most appropriate for each. Take a look and see which one best fits your personal circumstances.

“I’m still deciding if holiday letting is right for me”

Holiday letting can be a lucrative enterprise but is not necessarily for everyone. Why not access our Help & Advice centre and read some of the articles that we have written to help you decide:

“I'm buying a holiday let property and will need a mortgage”

Situation 1: I am still searching for the right property:

Our recommended actions are:

- Click to play with our holiday let affordability calculator and use the sliders to find out how much you might be able to borrow.

- Create an account and complete the first section called “Get started” which goes through some key screening questions and offers the chance to request an Initial Assessment from an Expert Advisor.

Situation 2: I have found the perfect cottage and I am now wanting to make an offer:

Exciting news! Our recommended actions are:

- If you have not done so already, create an account and complete the first “Get started” section and complete the Initial Assessment to see what you might be able to borrow, based on your circumstances.

- Once passed, complete the journey up to and including the “My property” section in readiness for your offer being accepted.

Situation 3: I have had my offer accepted and now need a mortgage ASAP!

Time to move quickly. Our recommended actions in this scenario are:

- Complete the “My mortgage” section and proceed to request Expert Advice and get your application under way!

“I already own a holiday let and want a mortgage / re-mortgage”

Situation 4: I’m thinking of getting a new mortgage or a remortgage on my existing holiday home:

Our recommended actions are:

- Get an idea of how much you might be able to borrow by using our interactive holiday let affordability calculator. If that looks good, then proceed to the next stage below.

- Create an account and complete the first section called “Get started” to undertake an Initial Assessment to see what you can borrow based on your circumstances.

- Once passed, complete the journey all the way to the start of the “My mortgage” section in readiness for the next step.

Situation 5: I want to proceed and get a mortgage/remortgage on my existing holiday let:

We hear you. In this situation, we recommend:

- Continue the journey until you get to Expert Advice and request a call to get your application underway!

How it works

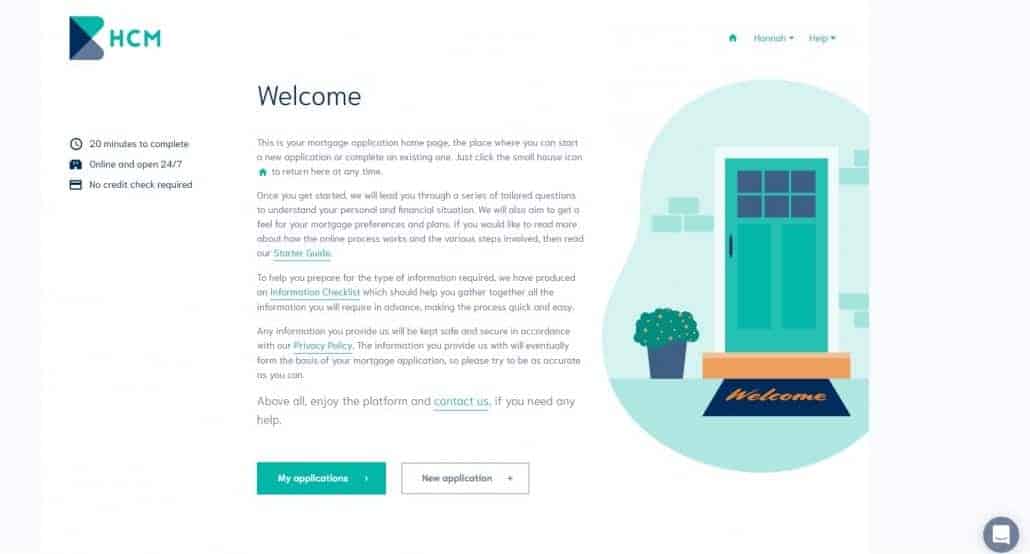

The journey begins when you create an account with us, validate your email address and then land on our Welcome page, as follows:

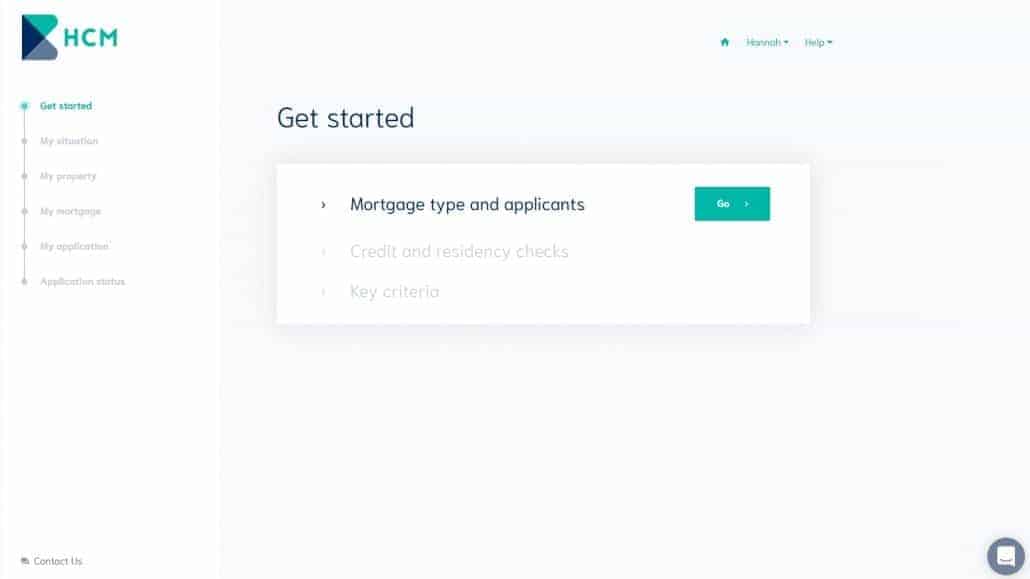

From here, you can start a new mortgage application, or review/edit an existing one. Once you begin or resume a mortgage application you move to the main dashboard screen, where you can see your journey bar to the left, and the associated steps to complete on the right:

As your advisor works through these sections, each time a new step is completed, you will get an email notification, and, if you have registered your mobile for SMS, a text message, to tell you that your application has progressed to the next stage.

If you were referred to us by one of our partnered holiday letting agencies, then in accordance with our Privacy Policy, your agent will also be notified of each step, so they can keep in touch with you and make suitable preparations for your property launch, saving time and potentially earning you more bookings that would otherwise be lost. If you would rather they didn’t get the notifications, you can always email your advisor and we will remove this link.